In January of 2023 I communicated to our investors our plans for localizing venture capital at FHV.

The gist of the communiqué was that we would be taking a more pragmatic approach towards tech investing in prioritizing line of site profitability and liquidity in 65% of the investments we make while allowing for traditional long term equity positions in the remaining 35%.

What this means is that 65% of the time we only make investments into businesses with the ability to liquidate our position from balance sheet in a not too distant future with a target of 48 months. In short, prioritizing profitability, healthy margins, and strong fundamentals.

At the time, we had already made six investments with the traditional venture approach of long term equity positions with hopes of a liquidity event sometime in the inscrutable future. Nine months down the road and our portfolio has grown to nine companies and we have kept in lock step with our revised thesis and portfolio construction model.

In 66% of the latest investments (2/3) we have structured deals around self liquidating instruments from balance sheet paving a path to a 3x return within 48 months in each case.

What is truly exciting about this strategy is the opportunity to recycle capital putting us in position to deliver a 3-5x return on the fund to investors. This type of performance would put us in the top decile of all venture funds anywhere.

The effect of this new approach has been to clarify and simplify our thinking on what makes for an attractive investment in this market which up until the market correction in tech stocks that begun in Q4 of 2021 had been very badly distorted. The correction quickly trickled down to the private markets forcing VCs and entrepreneurs to contend with the uncomfortable reality that good business fundamentals are back in vogue. Essentially, back to basics.

Prior to the correction the venture play book was built around ever increasing valuations as the North start metric above all else.

To attract venture dollars all startups had to do was show a multiplying top line with no one caring about what appeared on the bottom. This was a direct result of a veritable Noah’s Ark level event in venture capital with tons of cash flooding into the asset class peaking in 2021 with US venture at an eye watering $345B allocation nearly twice the previous year.

This led to voracious competition in the land of the birth of venture capital, which as most American things tend to, spilled over globally. In the same year Africa more than doubled its previous record from 2020 to a head spinning $5.2B deployed into tech startups. Every week of 2021 saw news on Tech Crunch of African startups receiving funding at a jaw dropping pace, amounts, and valuations. The euphoria was everywhere.

With all this competition among themselves, Venture Capitalists were desperate for near term signals to communicate their value to their investors (Limited Partners) so as to position themselves to go back for more capital that they could ship out the door at break neck speed in rinse and repeat fashion, a veritable auction with startup valuations as the bid.

The message to entrepreneurs was clear, profits don’t matter. Show me multiplying top line at any cost, was the cry from VCs. The pressure to chase growth was all too real. For African founders this translated to geographic expansion at the earliest possible moment of existence as an indispensability to raising capital.

VC to Nigerian founder: when are you getting to Kenya?

VC to Kenyan founder: when are you getting to Nigeria?

Both in unison: immediately!

Critically, 99% of the venture capital at work in Africa is in the hands of foreign investors many of whom do not reside on the continent and suffer from the inevitable blindspots brought about by lack of context, their perspectives lifted whole cloth from their home markets which are obviously very different from how things work in Africa.

Africa is not just not a country, it is in many respects the antithesis of a country.

The difference between Nigeria and Kenya from a cultural, technological, regulatory and infrastructure perspective are non trivial which often means that when a startup is crossing over into either of these markets from the former one, it needs to be rebuilt with an entirely new operational stack including elements of tech as the existing one does not port over smoothly. Building a startup in one market is difficult enough, doing so in two markets simultaneously is a death sentence 99% of the time.

I remember sitting down with one of our portfolio CEOs in April of 2022 after he had struggled to raise a new round just when the market correction was beginning to bite. Like everyone else he had embraced the thousand mile-wide-inch-deep strategy as a proxy for value creation and catalyst for fundraising. My message to him was that by failing to raise at what was a stratospheric valuation, he had dodged a bullet, and, should reconsider his strategy to double down on his home market which he eventually did. They have since posted profits in their home market and are now embarking on a robust company building strategy that would not have been in his purview or even possible if they were stretched thin chasing geographic driven valuations.

Message to African Founders

Your default strategy should be going deep in your home market with a primary goal of profitability. Default alive for African startups is profitability, and in almost all cases this can best be achieved in one’s home market or very near abroad, unless in cases where the business model necessitates presence in multiple countries to realize value ala Flutterwave etc.

At FHV we invest disproportionately in startups that have a strong bias towards primary market profitability as a core modality, and further, founders who embrace this point of view as core to their strategy.

Dawn, not Demise

The recent news of shuttering of well capitalized startups in Kenya is not a sign of techs demise, rather, it is a clear signal of the dire need for experienced local venture investors with mature points of view as bulwark for blindspots and hype.

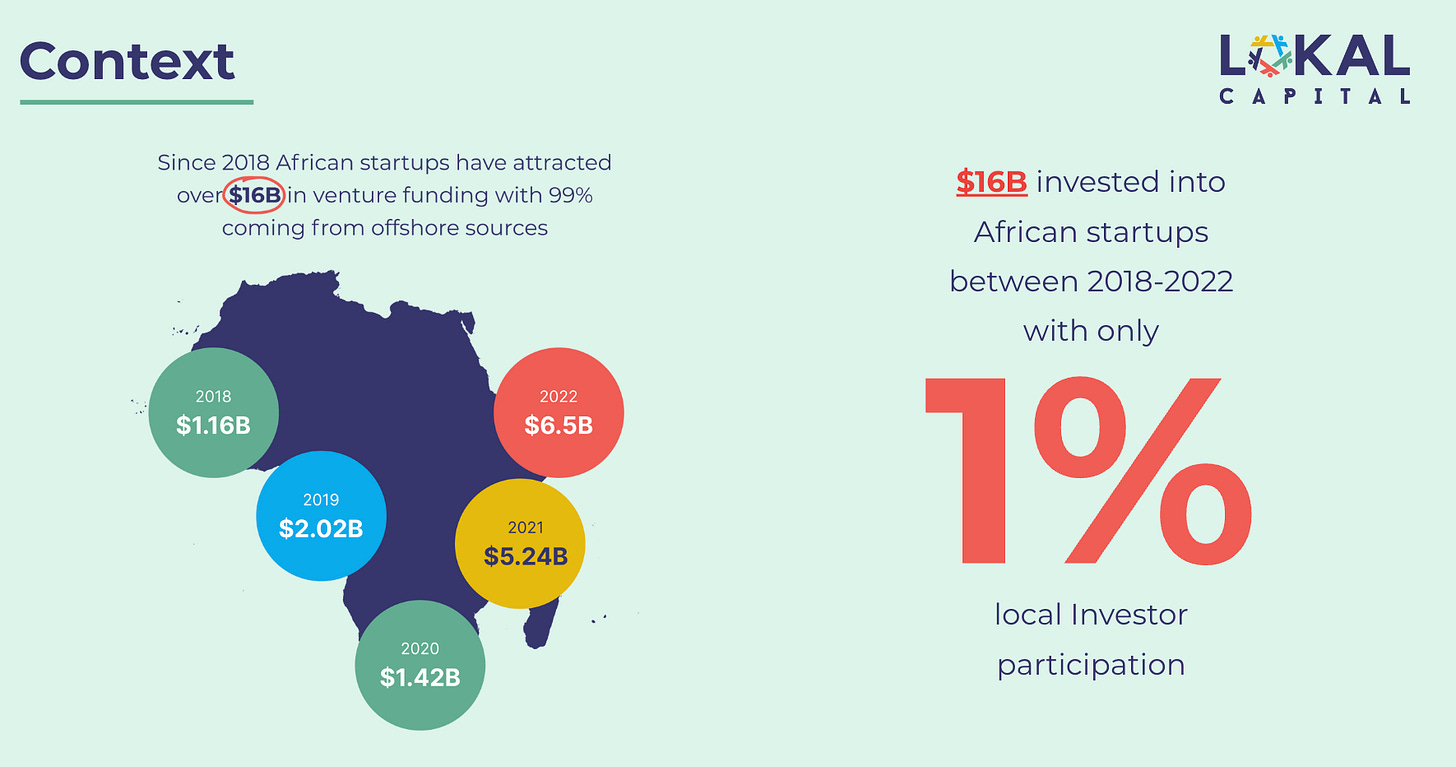

Further, if the ecosystem flywheel is to kick into high gear, it is critically important to activate local capital which at present is for all intents and purposes dormant in as far as startups are concerned. Between 2018-2022 African startups absorbed $16B in venture funding with a local participation rate at a paltry 1%.

Which is why we are super excited about Lokal Capital, a community based venture capital model designed to enable local investors participate in transformative local innovations, an idea whose time has come emerging from our venture studio at Impact African Network.

We are currently proving the model by allowing local investors to participate in these three exciting startups; Shukran, Elevate HR, and Kinetic Education.

What we are seeing right now in our investment pipeline is amazing. The quality of founders and projects is the highest order. I have never been more excited about the potential for tech in Africa.

Nairobi's Matriculation (Trimesters 1 - 4)

In Nairobi, we are in our 3rd trimester as a startup ecosystem.

Trimester I: 2010-2015 was marked by the emergence of tech hubs (iHub and Nailab) as points of aggregation of what was really prepubescent excitement with young techies throwing all manner of directionless mud on the wall with pretensions of doing something meaningful with the odd idea taking shape e.g. Africa’s Talking.

Trimester II: 2015-2020 saw a maturation marked by capable entrepreneurs launching meaningful projects quite a few of which have gone onto achieve meaningful scale including Twiga, Lipa Later, Pezesha etc

Trimester III: 2020-2025, we are now in the final five quarters of our 3rd trimester, and market correction not withstanding, there is a unquestionable cumbrian explosion happening in Nairobi right now the results of which will become apparent in the next 3-4 years.

Trimester IV: 2025-2030 will witness the coming of age of Nairobi’s tech scene as many of the projects currently underway in the hands of capable 2nd and 3rd founders and operators come to the fore.

Serendipity or Destiny

And in what can only be described as universal serendipity of intergalactic proportions we have been blessed with the immeasurable good fortune of having the indefatigable Meg Whitman as US Ambassador to Kenya who has been tirelessly championing the country as the doorway to the continent. Timing couldn’t be better.

US Ambassador Meg Whitman graced the Launchpad launch event on May 9th 2023.

Onwards and upwards!